Basic Cap Table For First Time Founders

So your in an emerging market and have already struggled to launch your startup and now it’ time to think about your capitalization table.

In simple terms the “cap table” is a record of ownership. The cap table provides an analysis of the founders’ and investors’ percentage of ownership, equity dilution, and value of equity in each round of investment.

There are hundreds of examples on how to format a cap table. In all cases excel is likely the best and easiest way to create and maintain a cap table:

- Names (and sometimes contact details) of the shareholders are in the left most column

- Capital contributions and units in the subsequent columns to the right

- Co-founders and groups of investors, from earliest to most recent, are sequenced top to bottom separated by rows clarifying the class of stock and option holders.

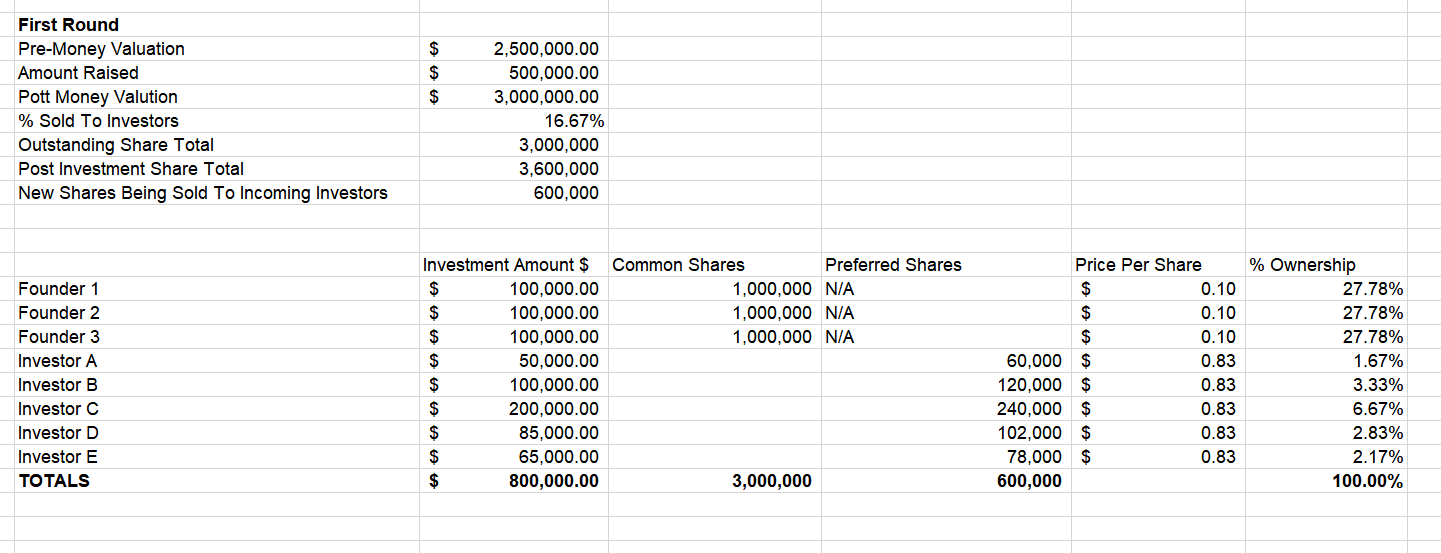

Looks simple enough (we have provided an example of a simple cap table below which can be viewed – it details 3 Co-Founders who contributed capital and are being transparent by sharing the liquid cash contributions, however often the co-founders do not need to share such details, the cap-table further shows an investment by 5 investors of varying amounts).

Keep in min the above is a first round cap table – managing the cap table can be chaotic, confusing and frustrating especially when bringing on more investors in future rounds. But if you’re a first time founder, all the more reason to get the structure right the first time from the get-go. As your company continues to grow and evolve, the cap table will help you keep track of who owns what.

When first structuring your cap table, there are certain terms and formulas that are important to understand such as

- Pre-Money Valuation: Value of your company determined prior to investment (in term sheet discussions)

- Price-Per-Share: Pre-Money Valuation/Pre-Money Shares

- Post-Money Valuation: Pre-Money Valuation + Total Investment Amount

- Post-Money Shares: Post Money Valuation/ Price-Per-Share

- Investor Percent Ownership: Investor Shares / Post-Money Shares

Always good to keep the cap table as simple and straightforward as possible to prevent any mishaps or confusion over stock ownership.

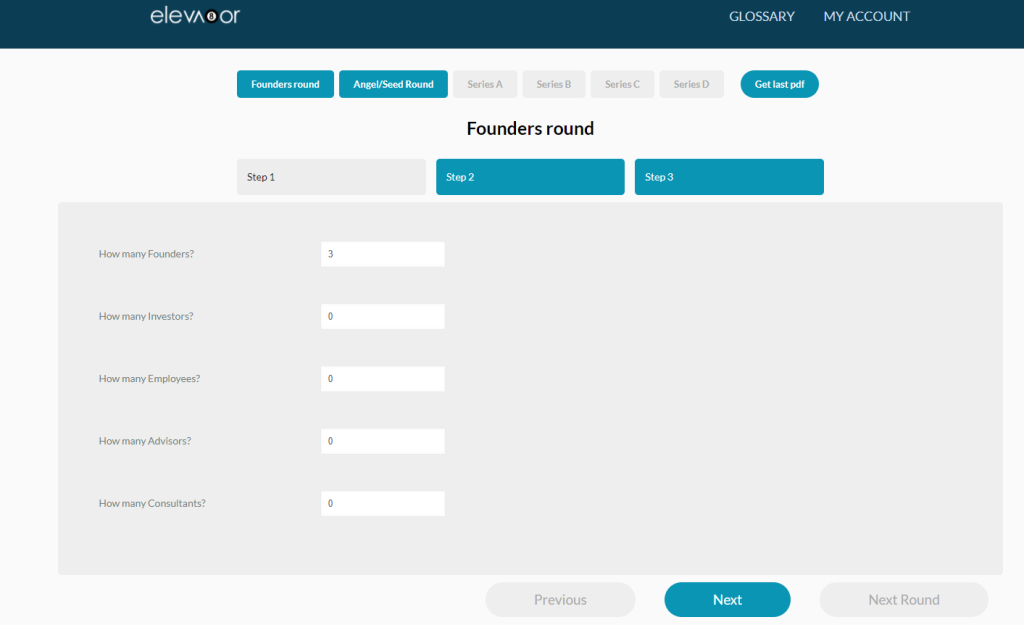

eleva8or’s online toolbox includes a fully-automated cab table builder (shown below), which you can easily use to gradually build yours as your startup grows.

If you have any further questions you can contact us at info@eleva8or.com and we will be happy to assist you further.